A Step-by-Step Insurance Claim Guide for Water-Damaged Floors

Water damage to your floor and property can be stressful. You have to coordinate cleaning, repairs and filing an insurance claim. The good news is that you can get financial help to restore your home if your insurance policy covers the damage. We’ll walk you through everything you need to know about filing a homeowners insurance claim for water damage so you can move forward with confidence.

Understanding Insurance Coverage for Water Damage

Water damage is one of the most common reasons people file home insurance claims. According to the Insurance Information Institute, water damage accounted for 27.6% of all home insurance claims in 2022 — a higher percentage than claims for fires or theft.

Water damage can come from many sources, including the following:

- A pipe burst in winter

- A dishwasher or washing machine overflow

- A roof leak during a heavy storm

- A sump pump failure that causes flooding in your basement

However, insurance companies do not treat all water-related events the same way. Some are covered, some aren’t, depending on the specifics of your policy.

What to Look for in Your Policy

To understand your coverage, pay close attention to these important terms in your insurance paperwork:

- Deductibles: This is the amount of money you have to pay before your insurance helps cover the rest of the repair costs. For example, if you have a $1,000 deductible and repairs cost $5,000, you’ll pay the first $1,000, and the insurance company will pay the remaining $4,000. A higher deductible usually means lower monthly premiums, but more out-of-pocket costs if something happens.

- Coverage limit: This is the maximum amount of money your insurance will pay for a water damage claim. For example, if your policy has a $10,000 limit for water damage, but the repairs cost $15,000, you’ll have to pay the extra $5,000 yourself.

- Endorsements: These are optional extra protections you can buy to extend your coverage beyond the basic policy.

Insurance documents can be full of complicated language. Most policies have a glossary or definitions section that clearly defines what certain terms mean. If anything is still unclear, don’t hesitate to call your insurance agent and ask them to explain your coverage and options for endorsements.

When Insurance Covers Water Damage

Most standard homeowners insurance policies will cover water damage when it results from sudden and accidental events. Here are some common examples:

- An appliance overflow

- A pipe that bursts unexpectedly

- Moisture damage from putting out a fire

- A leak from roof damage during a storm

These events are usually covered because they happen without warning. That said, coverage can vary significantly between insurance providers, so you must closely review your policy details to be safe.

When Water Damage Isn’t Covered

Every insurance policy has exclusions and limitations that property owners must know. They include:

Flood Damage

Most policies exclude flood damage because it’s high risk. It has the potential to spread widely and require significant repairs or complete rebuilding, which costs a lot. Floods are also unpredictable except in areas prone to them, making it challenging for insurers to accurately assess risk and manage costs. For these reasons, you must purchase a separate flood insurance policy.

The National Flood Insurance Program (NFIP) is the most widely used flood insurance in the U.S. It’s backed by the federal government and provides flood insurance to protect your property from flood damage. There is also a growing number of private flood insurance companies.

Gradual Damage

Insurance policies won’t cover moisture damage if the cause is a lack of property maintenance or neglected repairs. For example, A slow leak that causes mold growth or a burst pipe caused by deteriorating plumbing won’t be covered. Most insurance providers classify these situations as consequences of normal wear and tear, making repair costs your responsibility.

Regular maintenance, such as having your plumbing inspected or properly maintaining appliances, can help prevent this type of damage.

Sewage Backup

Sewage or drain backups can cause sudden and disgusting messes. However, they’re usually not covered under a standard policy either because they can happen for many reasons, including:

- Heavy rains or flooding overwhelming the sewer system

- Blockages in the city’s main sewer line

- Tree roots invading sewer pipes

- Power outages that stop sump pumps or septic system pumps from working

Because sewer backups can be hard to predict and the cleanup is expensive and hazardous, most insurers exclude this type of damage. Luckily, you can add a sewer backup endorsement to your existing policy or buy separate coverage.

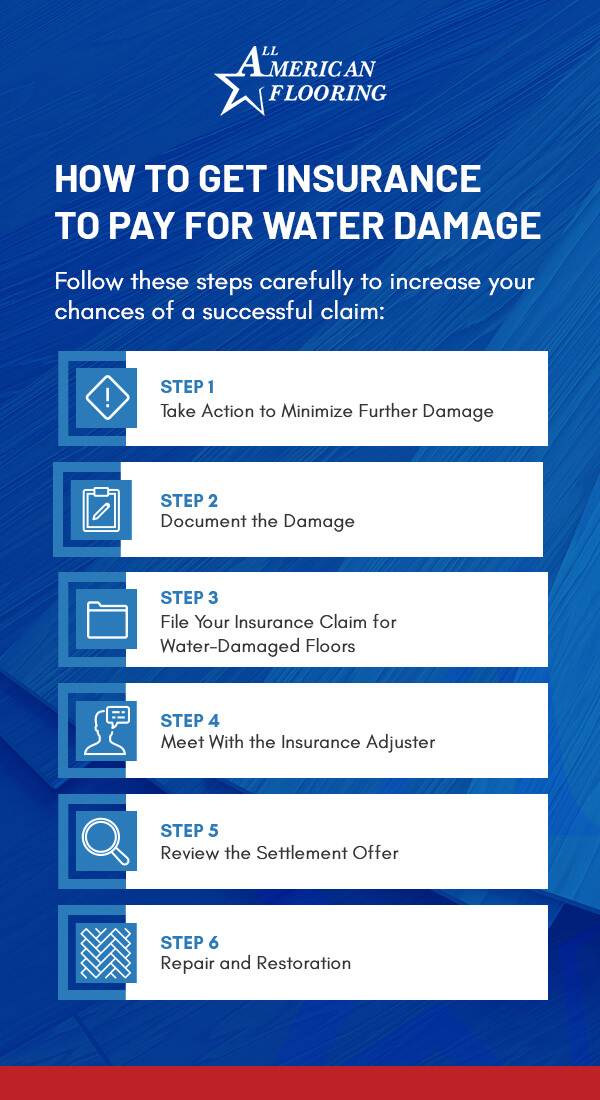

How to Get Insurance to Pay for Water Damage

Follow these steps carefully to increase your chances of a successful claim and restore your home without unnecessary hassle:

Step 1: Take Action to Minimize Further Damage

The first step when dealing with water damage is to take whatever action is necessary to stop the damage from worsening. Here’s how to do it:

- Shut off the main water supply to stop water from flowing where it shouldn’t.

- Place tarps over leaky areas, like under a roof.

- Move belongings away from affected areas to prevent additional damage.

- Begin drying the area using fans or dehumidifiers.

If there’s too much water to remove, you may need the help of a water damage contractor with equipment to pump out standing water and dry surfaces before the damage spreads and mold starts growing. According to the United States Environmental Protection Agency (EPA), you can prevent mold growth if you dry wet or damp materials and areas within 24-48 hours after they come into contact with moisture.

Taking steps to mitigate further damage demonstrates to your insurance company that you’re proactive and concerned about minimizing losses. As a result, you’re more likely to have a smoother claims process.

Step 2: Document the Damage

The success of your claim will largely depend on how well you document the water damage. Your insurance provider will need as much detail as possible to assess the value of your claim. Well-documented evidence will help with this. Proper documentation will also help you avoid delays and disputes with your provider during the claims process.

Here’s what to do:

- Take photos: Capture images and videos of the affected areas from multiple angles, including close-ups. If you hired a water damage restoration team, they will likely take photos, but you should take your own as backup.

- Record dates and time: Note exactly when you discovered the damage and document all actions taken to prevent damage escalation.

- List damaged property: In addition to photos and videos, keep a list of all damaged items, including electronics, furniture and appliances.

- Keep receipts: If you had emergency repairs done or hired a company to dry the place and prevent further damage, keep all receipts and present them as you file your claim.

Step 3: File Your Insurance Claim for Water-Damaged Floors and Other Property

Once you’ve documented the damage, file your claim with your insurance company. It’s important to report the damage as soon as possible to avoid delays that can complicate the claims process or result in a denial. You may be required to fill out forms with details about the damage, including when it happened, its cause and extent.

Ensure that you record all the phone calls, emails or letters exchanged with your insurance company so you have a paper trail in case of disputes.

Step 4: Meet With the Insurance Adjuster

After filing the claim, your insurance company will assign an adjuster to your case. The work of an insurance adjuster involves the following:

- Evaluating the extent of the water damage

- Reviewing your documentation

- Asking questions about the incident to verify claim details

With all this information, the adjuster will be able to determine who (if anyone) is at fault for causing the damage and estimate repair or restoration costs.

While the adjuster’s review will be thorough, it’s always beneficial to walk them through the damaged areas in person and provide your records of the damage and any mitigation steps you took. This way, you’ll be able to point out areas they might overlook or ask questions and bring up concerns you may have.

Step 5: Review the Settlement Offer

Once the assessment is complete, your insurance adjuster will send you a settlement offer that includes the amount of money your insurance provider is willing to pay for repairs and other costs associated with your claim.

You must review this offer carefully because sometimes the amount offered may be too little to cover repairs. There may also be discrepancies with the damage they documented. You can dispute the offer and negotiate with your provider for higher compensation if the settlement fails to meet your needs.

Step 6: Repair and Restoration

Once you accept a settlement offer, repairs come next. At this stage, we recommend obtaining multiple quotes from different contractors to compare prices and services. Ensure the contractors you work with are licensed and insured so you’re covered if something goes wrong due to their workmanship.

You can share your adjuster’s report with the contractors to ensure they understand the scope of work covered by your policy and what you’re willing to pay out of pocket. This way, you can prevent misunderstandings and ensure that repairs are completed to your satisfaction. Also, document all repair activities, including costs and contractor information, as this could be useful for future reference.

How to Handle Water Damage Claim Denials and Disputes

If you believe your insurance claim was wrongfully denied or undervalued, you have several options to challenge the decision:

- File a formal appeal directly with your insurance company: You can submit a written request asking the insurance company to review your claim again. You’ll typically need to provide additional evidence, photos, repair estimates or expert opinions that support why you believe the decision was incorrect.

- Request a re-inspection of the damage: You can ask the insurance company to send another adjuster to reassess the damage to your property. Sometimes, a second inspection can uncover details that were missed or underestimated during the first evaluation, potentially leading to a revised claim amount.

- Hire a licensed public adjuster: A public adjuster works for you, not the insurance company. They independently evaluate the extent of your damage, calculate the repair costs and negotiate directly with your insurance provider to help you get a fair settlement. This can be especially helpful if the claim is complex or the damage is extensive.

You may consult an attorney specializing in insurance disputes if these steps don’t resolve the issue. They can help you understand your rights and determine if legal action is appropriate for your situation.

Contact All American Flooring for Professional Guidance and Repairs

You don’t have to deal with water-damaged wood floors or carpet alone. At All American Flooring, we’ve been serving homeowners and businesses in the Dallas-Fort Worth area for over 35 years. Our experienced team understands how to file an insurance claim for floors, and we can help you navigate the process.

We’re here to help you restore your home with quality flooring at unbeatable prices. When you want to replace or upgrade water-damaged flooring, choose from our wide selection of hardwood, carpet, tile, laminate, natural stone and luxury vinyl. Schedule your free in-home estimate today or call us to learn more.

Water Damage Insurance Claims for Floors FAQs

1. How Long Do I Have to File a Water Damage Insurance Claim?

Most policies require you to file as soon as possible, often within 30–60 days of discovering the damage. You can review your policy document for more accurate details or contact your insurance company to understand the deadlines and requirements.

2. Does Water Damage Insurance Cover Mold Damage?

If the mold growth directly results from a sudden event — such as a water heater leak, a washing machine overflow or a burst pipe — your policy may cover both the water damage and the resulting mold remediation. Insurance companies usually view these incidents as accidental and unforeseen, often making them eligible for coverage.

On the other hand, if the mold developed over time due to a slow, unnoticed leak, ongoing moisture problems or lack of maintenance, most standard policies will deny the claim. It’s always a good idea to review your policy details or speak with your insurance agent to understand exactly what mold-related damages are covered and what limitations or exclusions may apply.

3. Can I Start Repairs Before the Insurance Adjuster Visits?

No. You should not start permanent repairs until your adjuster has seen the damage. If you fix things too early, it could affect your claim because the insurance company won’t be able to assess the original damage properly.